Info shows that Bitcoin trader sentiment has cooled to the cheapest level considering the fact that February, some thing that could facilitate a rebound in the selling price.

Bitcoin Anxiety & Greed Index Now Factors At Just ‘Greed’

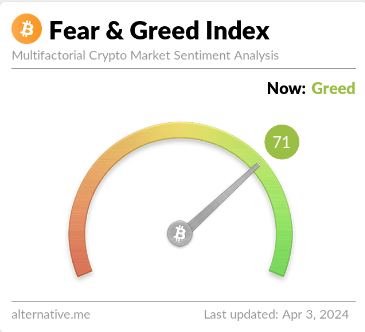

The “Fear & Greed Index” is an indicator produced by Substitute that tells us about the common sentiment among the buyers in the Bitcoin and broader cryptocurrency sector.

This metric makes use of a numeric scale from zero to hundred to represent the sentiment. To work out the rating, the index considers the data of 5 variables: volatility, investing volume, social media sentiment, market cap dominance, and Google Trends.

All values of the indicator higher than the 53 mark propose the existence of greed among the investors, although below the 47 amount implies a fearful current market. The area in between these two corresponds to the neutral sentiment.

Here is how the most recent benefit of the Bitcoin Panic & Greed Index seems to be:

As is obvious higher than, the Bitcoin Anxiety & Greed Index currently has a worth of 71, implying that the traders share a greater part sentiment of greed. Just yesterday, the index’s worth had been notably increased than this, implying that there has been a bit of a cooldown of sentiment in the past 24 hrs.

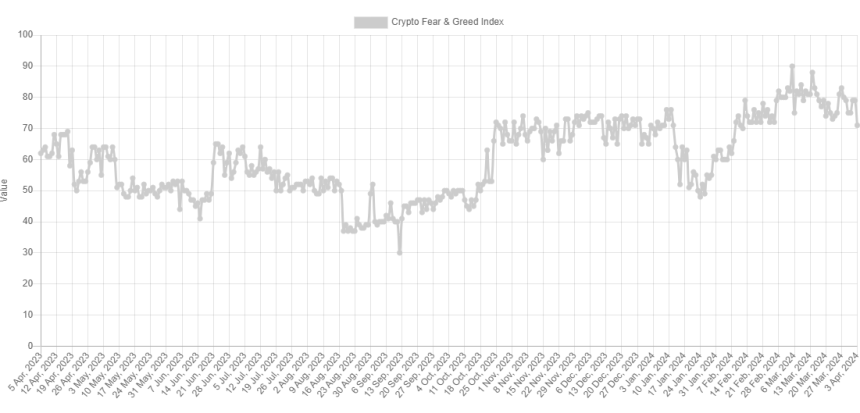

Beneath is a chart that shows the trend in the index above the earlier 12 months.

Aside from the three main sentiments, there are also two “extreme” sentiments: intense greed and serious concern. The former happens at values earlier mentioned 75, whilst the latter occurs below 25.

The Bitcoin Dread & Greed Index was 79 yesterday, implying that the sector experienced been extremely greedy. The indicator has been frequently inside this zone for the previous month, so the present-day regular greed values go in opposition to the craze.

The sentiment among buyers has in a natural way been so substantial just lately for the reason that the BTC rate has gone by a sharp rally in this time period and has explored refreshing all-time highs (ATHs).

The Bitcoin rate has traditionally tended to go versus the majority’s expectations. And the stronger this expectation has been, the more possible these a opposite shift will come about.

Because of to this explanation, the extreme sentiments have been where reversals in the asset have been the most possible to consider spot in the previous. For occasion, the present ATH of the asset shaped when the index was at a value of 88.

With the recent rate drawdown, sentiment has also taken a hit. The simple fact that it has fallen out of the extreme greed zone, even though, may possibly be conducive to a bottom forming. The earlier base, about 20 March, also formed when the index exited the zone.

The present-day amount of the Bitcoin Worry & Greed Index is not only reduce than it was then but also the cheapest because 11 February, when the asset was however trading all-around $48,000.

BTC Rate

Bitcoin is now down to the $65,800 amount following experiencing a drawdown of far more than 7% around the previous number of times.

—

On line:

Information organizations contributed to this report, released by ORDO Information editors.

Make contact with us: speak [email protected]

Our Specifications, Terms of Use: Normal Conditions And Situations.

To eliminate any confusion arising from different time zones and daylight conserving variations, all occasions displayed on our platforms are in Coordinated Common Time (UTC).

ORDO News contributed to this report.